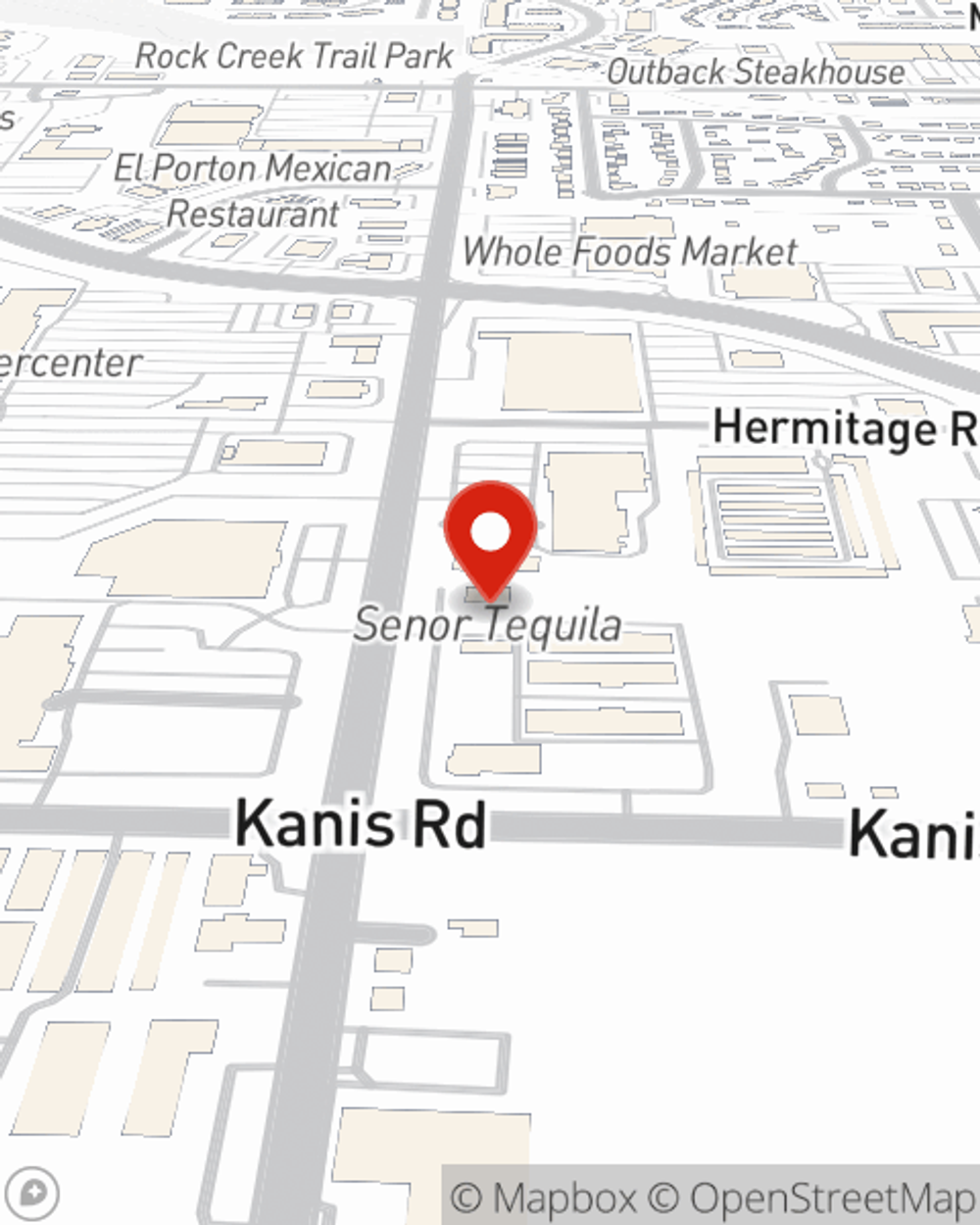

Life Insurance in and around Little Rock

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Providing for those you love is what keeps you going every day. You help them make decisions listen to their concerns, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

You’ll get that and more with State Farm life insurance. State Farm has terrific coverage options to keep those you love safe with a policy that’s modified to match your specific needs. Fortunately you won’t have to figure that out by yourself. With empathy and fantastic customer service, State Farm Agent Justin Terry walks you through every step to create a policy that secures your loved ones and everything you’ve planned for them.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to check out what a State Farm policy can do for you? Contact State Farm Agent Justin Terry today.

Have More Questions About Life Insurance?

Call Justin at (501) 224-7700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Justin Terry

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.